Inspired by new opportunities. Guided by intellectual honesty.

What We Do

ABOUT US

DSJ GLOBAL INVESTORS was founded by Mr. Dhawan Punukollu in 2024

We embrace the value investment principles of Warren Buffett and Charles Munger. We aim to achieve superior returns by being long-term owners of high quality companies with substantial “economic moat”, and great growth potential, and run by trustworthy people.

Investment Philosophy

“In making investments, we have always believed that you must act with discipline whenever you see something you truly like. To explain this philosophy, Buffett/Munger likes to use a baseball analogy that I find particularly illuminating, though I myself am not at all a baseball expert. Ted Williams is the only baseball player who had a 400 single-season hitting record in the last seven decades. In the Science of Hitting, he explained his technique. He divided the strike zone into seventy-seven cells, each representing the size of a baseball. He would insist on swinging only at balls in his ‘best’ cells, even at the risk of striking out, because reaching for the ‘worst’ spots would seriously reduce his chances of success.

As a securities investor, you can watch all sorts of business propositions in the form of security prices thrown at you all the time. For the most part, you don’t have to do anything other than be amused. Once in a while, you will find a ‘fat pitch’ that is slow, straight, and right in the middle of your sweet spot. Then you swing hard. This way, no matter what natural ability you start with, you will substantially increase your hitting average. One common problem for investors is that they tend to swing too often. This is true for both individuals and for professional investors operating under institutional imperatives, one version of which drove me out of the conventional long/short hedge fund operation. However, the opposite problem is equally harmful to long-term results: You discover a ‘fat pitch’ but are unable to swing with the full weight of your capital.”

—Dhawan Punukollu

We are business owners...

TEAM

Dhawan Punukollu is the Founder and Chief Investment Officer of DSJ Global Investors, a value investing firm he has led since 2024. With over 15 years of equity investment experience, Dhawan specializes in value and growth investing. Born in India, he now resides in Singapore, where he manages the firm’s new compounding fund.

Sangeetha Punukollu is the Chief Investment Risk Officer at DSJ Global Investors. Born in India and now residing in Singapore, Sangeetha plays a vital role in managing and mitigating the risks associated with investment activities. She serves as the primary advisor to the CIO and the investment committee on all risk-related matters.

Jenith Punukollu is a securities research analyst at DSJ Global Investors. Born in India and now residing in Singapore, Jenith began his investment journey at the age of 11. He consistently selects high-quality companies with significant economic moats, excellent growth potential, and trustworthy leadership.

Core Investment Principles

Core Investing Mission

Our mission is to deliver superior investment results with risk under control and to conduct our business with the highest standards of integrity, ethics, and professionalism.

Patience and Long-Term Thinking

Success comes to those who are patient, disciplined, and emotionally stable. Our investing and decision-making focus on long-term goals rather than short-term rewards.

Avoiding Market Timing

Never go all-in on entry. Never sell everything on exit.

Avoiding Shorting

We believe in long-term growth and do not engage in short selling.

Avoiding Leverage

We commit to making investments without using borrowed capital.

Economics Moats

We buy businesses with durable competitive advantages, Eg, brand power,cost leadership, network effects, regulatory barriers.

Skin In The Game

We invest alongside management teams who have personal stakes in the business.

Avoiding Turnarounds

Turnarounds rarely trun, and we avoid those businesses.

Focus On Owners Earnings & ROIC

We focus on cash flow and owners earnings and priortize businesss with high consistent ROIC

Our 6- Steps Framework to Select Stocks...

1

Understand the Business

What does the company do?

Is it easy to explain in a single sentence?

Identify the industry & Moat

What are its competitors?

Does the company have pricing power or brand strength?

Can others easily replicte the business?

Deep Dive Into Financials

From the balance sheet

Is the company debt-free?

Is the current ratio above 1 for liquidity?

Does the company have a consistently strong cash position?

From the income statement

Are profits consistently growing YoY?

Are operating margins stable or improving?

Is the net margin better than peers?

From the cash flow statement

Is the company generating +ve CF?

Is it reinvesting in the business?

Does it have growing free cash flow?

Evaluate Growth Potential

What are the future plans[new products]?

Are earnings expected to grow 15%+?

Analyze Valuation

Is the P/E reasonable for its sector?

How does it compare to historic valuation?

Is the stock undervalued based on PEG or internsic value?

Study Promoter & Insider Beh

Are promoters increasing their stake?

Are there consistent insider purchase?

2

3

4

5

6

Staged Entry & Staged Exit

Our strategy is focused on sustainable investments, not on predicting market movements.

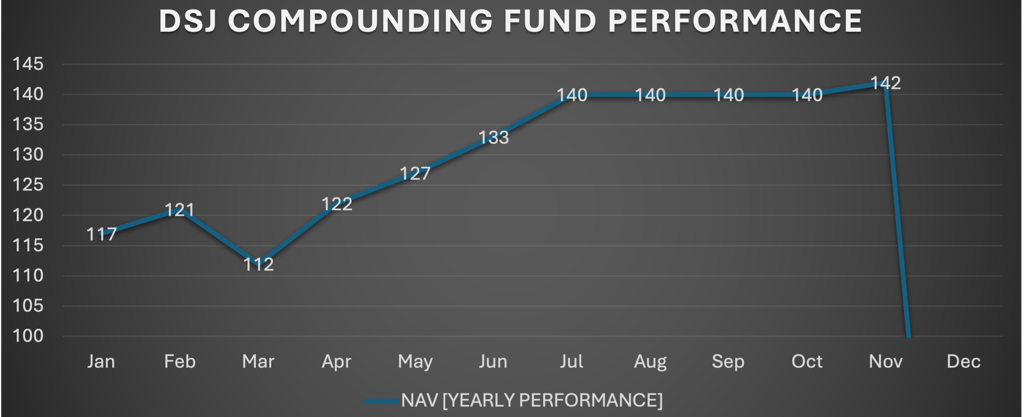

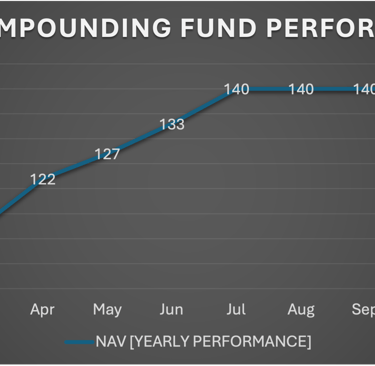

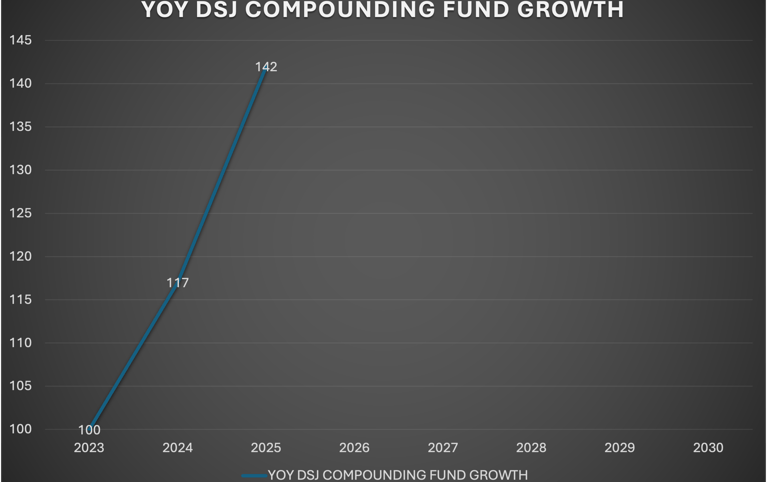

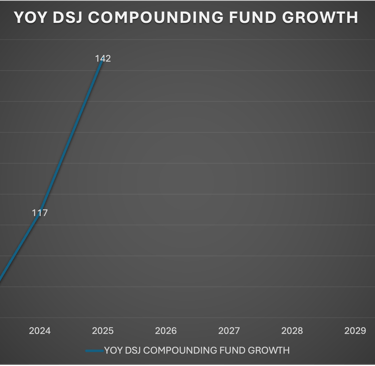

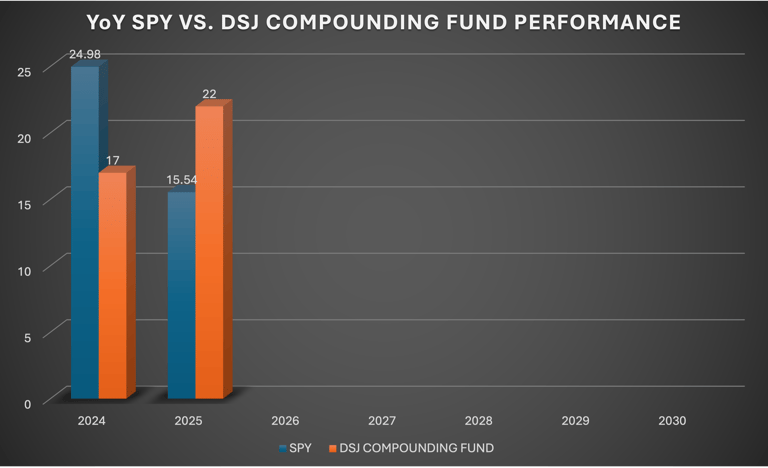

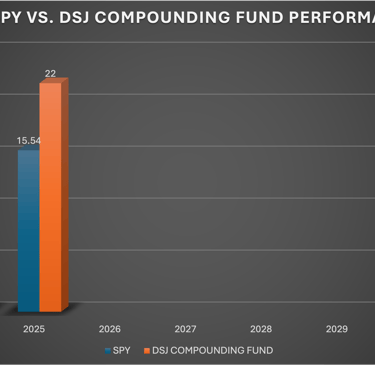

Performance

Investment Tracker

As outlined in our investment philosophy, we follow the strategy of baseball player Ted Williams. We divide investment opportunities into 50 zones, each representing a defined potential profit. We invest only when we identify a substantial profit opportunity within these zones. Throughout our life, we will limit ourselves to making only 50 trades. Period!